Clack has acknowledged world-leading expertise in Blockchain and Smart Contracts and has made contributions to scientific knowledge across a range of areas within computer science.

-

Smart and Computable Contracts

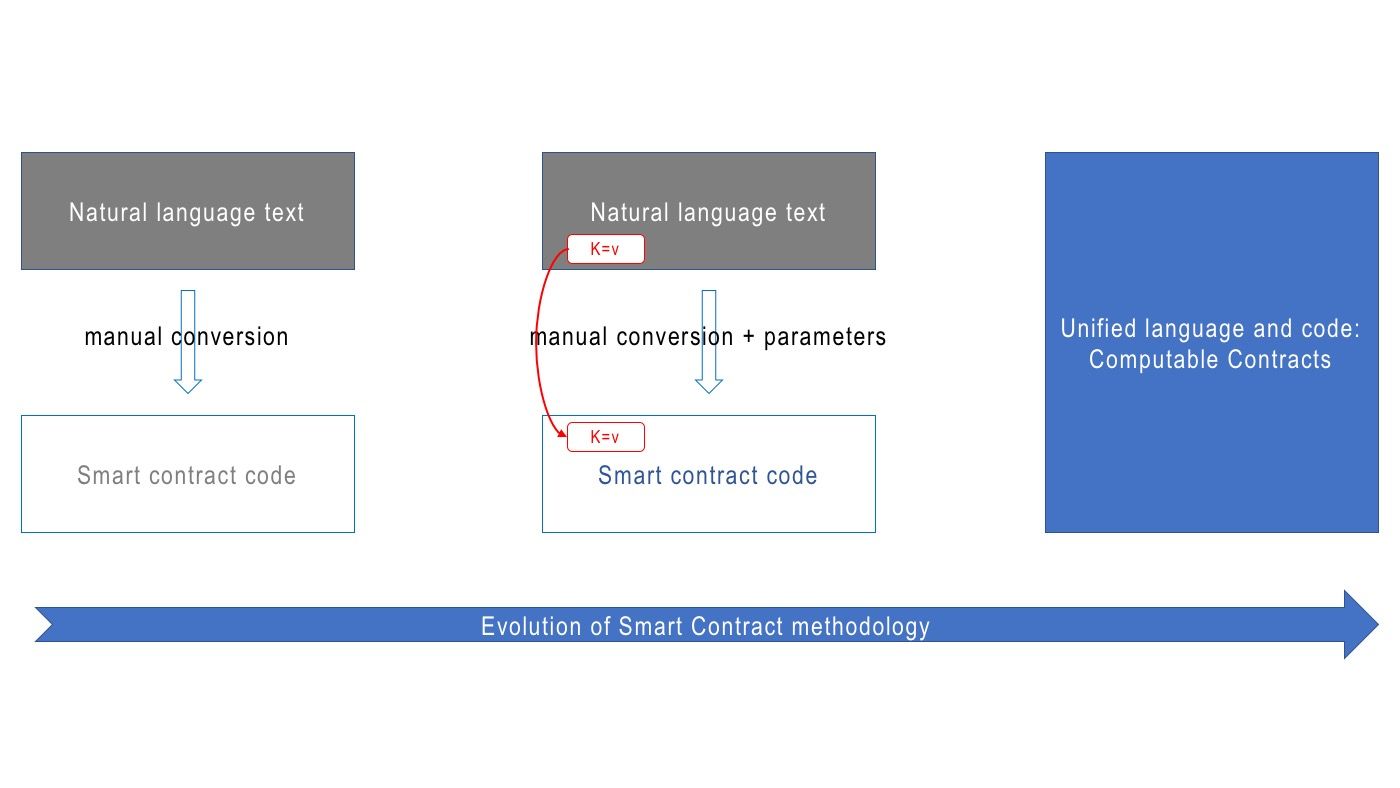

Most of Clack's research since 2015 has been in the area of Blockchain and Smart Contracts. The focus has been especially (but not solely) in the area of smart contracts for long-lived high-value financial derivatives: (i) Smart Contract Templates, (ii) analysis of the semantics of legal contracts, and (iii) Computable Contracts. The latter work on Computable Contracts has evolved from close engagement with lawyers and an increasing understanding of the interplay between legal agreements and smart contract code.

-

Parallel functional programming, abstract machines and strictness analysis

Clack's early work with Simon Peyton Jones and others focused on the design and development of the “Graph Reduction In Parallel” (GRIP) machine for parallel functional programming, including system architecture design, strictness analysis and abstract machine design; his work in this area continued beyond the GRIP project with the development of a dynamic profiling technique and advisory work in system architecture design for securities settlement systems in the finance sector.

-

Financial Evolutionary Computing

Clack's research in the area of financial evolutionary computing has for the most part explored financial applications of genetic algorithms (GAs) and genetic programming (GP). This work contributed to evolutionary computing technology as follows:

- Gene dominance during crossover (providing a form of genetic memory for GAs).

- Improved efficiency and expressivity of GP technology via strong typing constraints, polymorphism, recursion, and lambda abstractions.

- Improving the robustness of GP solutions via the maintenance of phenotypic diversity in the population, with volatility-adjusted fitness and voting mechanisms. This work demonstrated a 300% performance improvement over standard mechanisms for investment portfolio optimisation, and has been shown to have superior performance to Support Vector Machines.

- Detecting the problem of anomalous risk-switching in multi-objective genetic programming. In particular, the work on multi-objective genetic programming in finance identified an important instability problem with efficient frontiers (a critical issue for automated investment).

A 2007 GECCO paper (Evolving robust GP solutions for hedge fund stock selection in emerging markets, Yan and Clack, 2007) won a Best Paper prize and Clack subsequently received over 20 invitations to give talks and run workshops at national and international conferences. This included invited talks at GECCO for three successive years (2008-2010). He received invitations to collaborate with international research groups (e.g. at Strasbourg, Complutense, and Budapest) and over 30 invitations to advise financial institutions: his new techniques for dynamically-optimised trading and investment were thereby transferred widely into industry and influenced the uptake of evolutionary computing approaches to automated trading and investment (e.g. by investment funds such as SIAM Capital)

-

Agent-based simulation and InterDyne

Clack has engaged in cross-disciplinary research in the area of agent-based simulation applied in the three areas of oncology, botany and finance. This led to advances in the simulation of morphological dynamics of living organisms (with the Natural History Museum), to in-silico testing of biological hypotheses such as cancer therapy (with UCL’s Department of Oncology), to his PhD student founding a laboratory for morphogenesis modelling (now “Integrated Computational Biology”) in the vascular biology department of Beth Israel Hospital at Harvard Medical School, and to the development of the InterDyne simulator.

The InterDyne Simulator is designed to support exploration of interaction dynamics and feedback effects in non-smooth complex systems. It is a general-purpose tool that can be applied to a wide variety of systems, though at UCL its primary use has been to simulate interaction dynamics in the financial markets.